Everything you need to know about invoice factoring for small business

When you’re running a business, you need customers to pay you on time. For many trades, payment terms for customers are usually anywhere from 30 to 90 days.

That can be a long time to wait. Especially if you have to pay suppliers for goods and materials before you start a job.

There are many ways you can coax and cajole customers into coughing up in a timely fashion. Tradespeople can also opt to pay someone else to do the chasing for them.

It’s called invoice factoring.

What is invoice factoring?

With invoice factoring you ‘sell’ your sales invoices to another company. They then pay you most of the amount due to your business upfront. This is usually 80-90% of the total amount the customer owes you.

It’s down to the invoice factoring company to collect the full amount from your customers. Next, you’ll receive most of the rest of the amount owed to you. It won’t be the full amount, though. You have to pay invoice factoring charges for the service.

Businesses at all stages of their growth can benefit from using invoice factoring. This includes invoice factoring for start-ups. Invoice factoring can also be helpful for sole traders.

In the right circumstances, invoice factoring could be the answer businesses are looking for. In the small business sector, the popularity of invoice factoring could be down to the difficulty in obtaining funding from banks.

Invoice factoring v invoice financing

You may hear both terms and think they’re the same. But there are some crucial differences:

With invoice financing:

- You still receive money upfront from an invoice financing company based on the value of your sales invoices

- But you loan the money from the invoice factoring company and have to repay it all

- You are responsible for chasing outstanding customer invoices

- You pay interest on the amount you borrow

- Your customer doesn’t need to know you have this arrangement in place

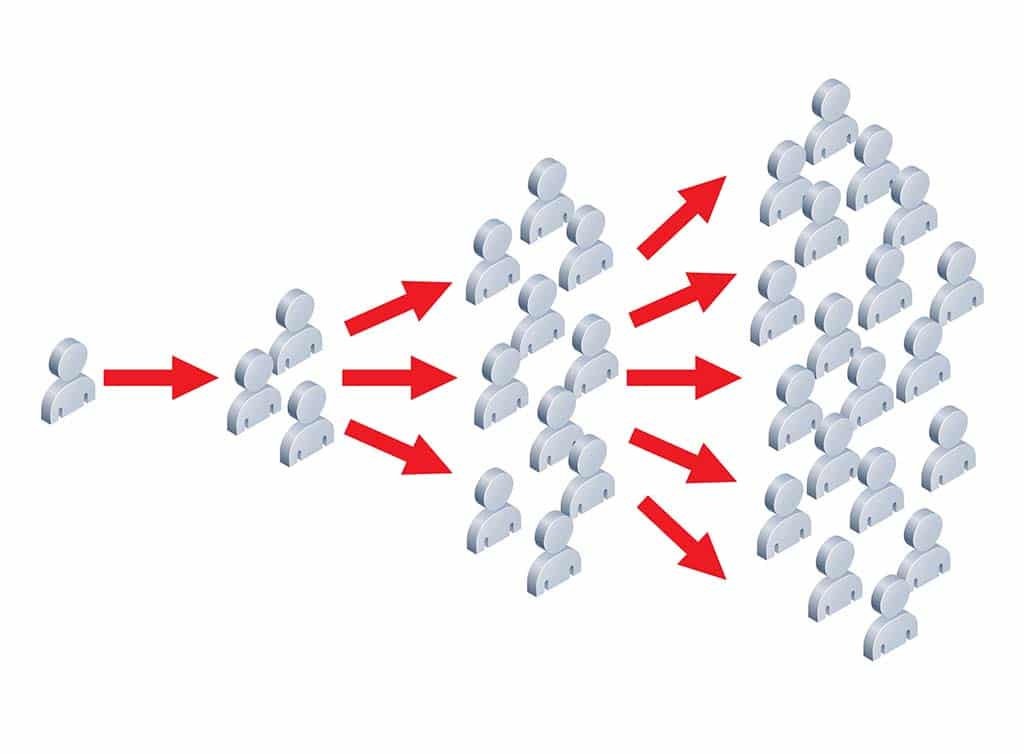

How invoice factoring works

These are the main steps in the process:

- Invoice your customers in the usual way

- Send the invoice to the factoring company

- You receive most of the amount owed to you immediately from the invoice factoring company

- Customers make payments directly to the invoice factoring company

- You receive the balance of the amount due to you (minus the invoice factoring charge)

If you choose invoice factoring, then you’ll probably need to make some changes to your invoices. You may need to add information as well as all the usual things that should go on an invoice.

These could include:

- Replacing your bank payment details with those of the invoice factoring company

- Changing your terms and conditions for paying the sales invoice

Cost of factoring invoices

Invoice factoring charges vary for a number of reasons. You’ll need to consider the type of business you run to get an idea of what invoice factoring rates might be.

The following can affect the cost of invoice factoring:

- Higher-value invoices usually mean lower invoice factoring charges

- The more sales invoices you issue each month can reduce the charges

- Late-paying customers could increase the invoice factoring rates

- The creditworthiness of your industry sector could make the invoice factoring costs higher

- The creditworthiness of your customers can also have an impact on invoice factoring rates

- Your financial track record also has a bearing on how much you could pay in invoice factoring charges

Typically, the cost of invoice factoring is 1.5% to 2.0% of the invoice amount. This could go to 5.0% or higher.

Also, invoice factoring companies might make additional charges over and above their core rates. You need to keep a close eye on what the total cost might be to use the service.

Advantages and disadvantages of factoring

Invoice factoring isn’t for everyone. Invoice factoring costs aren’t the only downside. It’s always best to do your homework carefully on the invoice factoring provider.

Make sure you are comfortable with the proposed arrangement – especially the invoice factoring company’s terms and conditions.

Here’s a round-up of the advantages and disadvantages of factoring:

Pros of invoice factoring

- Usually easier and quicker to obtain invoice factoring than getting a bank loan

- Improves your cash flow by receiving money owed to you quicker

- A healthier cash flow can help you get other forms of credit

- Gives you access to money to grow your business and increase sales

- Helps you to control your finances better

- Allows you to give your customers a bit longer to pay what they owe

- Reduces the risk of bad debts from non-paying customers

- Takes away the hassle of chasing customers for payment

- Frees you to concentrate on running your business

Cons of invoice factoring

- If you only have a small number of customers then it might be expensive to use

- You don’t receive the full amount (minus charges) upfront so if your customers always pay promptly then it might not be worth doing

- You make less profit on jobs as you have to pay invoice factoring charges

- Invoice factoring rates can be high

- You don’t own the customer debt so you can’t chase them for late payment. You could be paying higher charges the longer customers take to pay the invoice factoring company

- You may not be able to use invoice factoring for customers who are bad at paying on time

- The invoice factoring contract could be for a longer period than you want and difficult to end without incurring further charges

- You’ll have to repay any outstanding amounts if you choose to stop the service

- Invoice factoring can have a poor reputation if companies exploit tradespeople with confusing and hidden charges

What you need to obtain invoice factoring

The main requirements needed by invoice factoring companies include:

- A business bank account

- Business details like your turnover and profit

- VAT details (if you are registered for VAT)

- Tax details

- Your business has to be generating sales invoices

- Your customers usually need to have a good credit history

Other customer payment options to consider

If the cost of invoice factoring puts you off the idea, then there are other ways of getting paid on time. One of these is to agree a payment schedule with customers.

You’d usually do this on a customer-by-customer basis. A payment schedule can improve your cash flow.

Going cashless is another way of ensuring prompt customer payments. By taking card payments using a hand-held card reader, the money goes straight into your bank account.

You’ll also know immediately if the payment has failed. So, it can help reduce the risk of unpaid customer debts.

The Department for Business & Skills has useful information to help tradespeople get on top of customer payments.

Key takeaways

- Invoice factoring can boost cash flow for a small business

- It works by ‘selling’ your sales invoices to an invoice factoring company that then collects the money due and pays you most of the amount, after taking its charges

- Invoice factoring can be quicker and easier to obtain than a bank loan

- The cost of invoice factoring can be high and it might not be appropriate for your trade business

- Invoice factoring charges will depend on various considerations, including your business history, your trade and your customers’ credit history

- You’ll need to provide solid business credentials to set up invoice factoring

Ready to take your business to the next level?

We can help you get there

DISCLAIMER

This is information – not financial advice or recommendation. The content and materials featured or linked to on this blog are for your information and education only and are not intended to address your particular personal requirements. The information does not constitute financial advice or recommendation and should not be considered as such. Checkatrade website is not regulated by the Financial Conduct Authority (FCA), its authors are not financial advisors, and it is therefore not authorised to offer financial advice.

Always do your own research and seek independent financial advice when required. Any arrangement made between you and any third party named or linked to from the site is at your sole risk and responsibility. Checkatrade blog and its associated writers assume no liability for your actions.

No comments yet!