Blog>News>Average property upkeep now costs 70% of a mortgage bill

Last updated: 31 March 2025

Average property upkeep now costs 70% of a mortgage bill

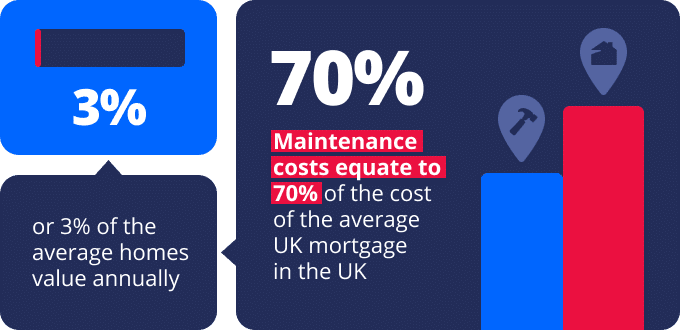

Average home maintenance costs in the UK are now equivalent to 70% of the cost of the average mortgage, according to new data from Checkatrade - the UK's leading platform for home improvement.

The research shows that homeowners spend an average of £627 a month on total maintenance costs - vs an average UK mortgage cost of £898.

This can also be compared to the value of a home. The average annual cost for maintenance is £7,530 - equivalent to just under 3% (2.8%) of the average UK’s home’s total value. With the average homeowner staying in a home for nine years, this means that they will spend £67,770 maintaining each property they own.

The percentage of mortgage cost remains relatively consistent regardless of the size of home. For example, the monthly cost of maintaining a flat works out to be 71% of the average mortgage cost. For detached homes, the figure is 75%. Meanwhile, for a three-bed home - the most popular size in the UK - the figure is 68%.

The research takes into account all costs associated with maintaining a property and separates them into different categories of maintenance for an all-encompassing view. This includes the type of work carried out by more than 50,000 vetted trade businesses on Checkatrade who facilitate over three million jobs in UK homes annually.

First, it looks at the cost of building repair and maintenance - both planned and emergency. This accounts for elements such as plumbing and electrical work, repairs to built-in appliances such as boilers, interior or exterior building work and structural work. This was found to average out at £283 per month, or £3,403 a year.

Next, the research investigates the cost of decorating or updating a home as needed - for example getting a new kitchen, bathroom, carpets and painting and decorating to ensure the home does not become dated. This was found to average out at £201 per month or £2,426 per year.

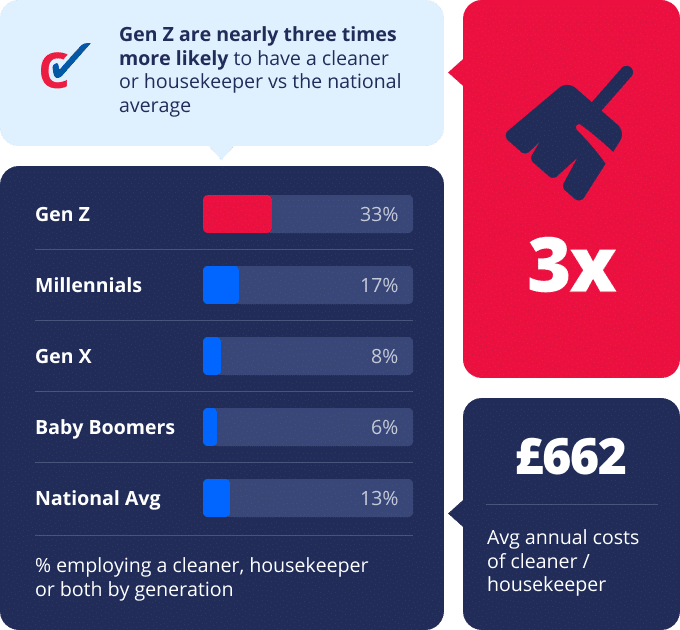

Gardens were also included for those that have one - looking at the cost of upkeep and maintenance, any planned or emergency work (such as fencing or patios), and a gardener for those who have one. This adds an extra £87 a month to the overall bill on average - or £1,038 per year. Finally, cleaning costs were added - including a cleaner or housekeeper for those who have one. This adds a further £55 a month or £662 a year to the average maintenance bill.

Gen Z homeowners are far and away the most likely to have a cleaner or housekeeper - 33% have one or both, vs a national average of 13%. Just 17% of Millennials, 8% of Gen X and 6% of Baby Boomers do. The average annual cost of cleaning maintenance for those who have a cleaner is £2,051 per year and for those with a housekeeper, it is £2,414.

The maintenance costs catch many by surprise - 31% say they were more than they expected when they bought their first home. In total, 41% say they had no budget for home maintenance at all when they bought their first property - while 27% say they did but it wasn’t enough.

Amongst those who said costs were more than expected, 37% say it meant they were not able to get work done to their new home that they hoped to - such as a new bathroom or kitchen. Meanwhile, 20% got into debt to cover maintenance costs and 13% could not afford ‘urgent’ repairs.

While maintaining a home is expensive, not maintaining it can be more so. Homeowners say that, on average, they would offer 11.3% less for a home in a very poor state of maintenance vs the same home that was in normal condition and 8.7% more for a home that was excellently maintained. Based on the average UK property price, that means homeowners are prepared to pay an average of £53,440 more for a home that is excellently maintained vs one that is poorly maintained.

For 28% of homeowners, there is an additional monthly maintenance cost to account for - service changes. Three-quarters of those who live in a flat (74%) say they pay a service charge that is ‘primarily for maintenance’. This adds an additional £124 to their monthly costs.

The figures come as Checkatrade launches its Home Health Report. The free-to-use tool provides an instant assessment of any UK home's current state and offers personalised maintenance recommendations tailored to specific needs. This proactive approach not only helps in identifying potential issues before they escalate but also contributes to improved energy efficiency and overall safety. Moreover, the report connects you with vetted and reliable tradespeople from the Checkatrade platform, ensuring that any required work is carried out by trusted professionals. Utilising the Home Health Report empowers homeowners to make informed decisions, effectively manage maintenance tasks, and ultimately add value to their property.

Jambu Palaniappan, CEO at Checkatrade, commented:

“The figures shine a spotlight on the costs associated with maintaining homes. While the figures may seem high, it’s important to remember that a significant building repair or new kitchen or bathroom can cost tens of thousands of pounds. Checkatrade simplifies the task of finding reliable tradespeople for these kinds of jobs.

“While putting aside hundreds of pounds each month for maintenance may seem like a big expense, it’s a false economy not to, given how much more homebuyers are prepared to pay for a home in excellent condition. Saving the equivalent of 70% of mortgage costs or 3% of home value annually are good rules of thumb to have enough.

“Of course, many don’t know where to start when it comes to maintenance. That is why we have launched our new Home Health Report, the latest innovation to come out of our in-house incubator Checkatrade Labs. All homeowners have to do is upload images of their home, and they will get a free report on exactly what they need to do to properly maintain it. This is all underpinned by unique reliable data that helps homeowners understand what jobs will improve property values. Any work then carried out by a Checkatrade-approved tradesperson booked through our platform comes with a 12 month workmanship guarantee*.”

What is Checkatrade Labs?

Checkatrade Labs is an in-house incubator focused on developing new technologies and business propositions that will accelerate the experience of getting work done to a home for consumers, tradespeople and beyond. The team is building multiple new products to break new ground through the use of technology and AI and comprises a mix of entrepreneurs, engineers, operators and product specialists.

Broken down maintenance costs for different types of home:

https://datawrapper.dwcdn.net/mHGQd/2/

https://datawrapper.dwcdn.net/Nmpkf/1/

Notes to editors

Research & References

Research conducted by Mortar Research amongst 2,022 UK homeowners between 21st-24th February 2025. This includes asking respondents their mortgage costs. UK average house price figure from Zoopla

For more information, please contact: checkatrade@goodrelations.co.uk