Blog>Trade>Starting a Business>Invoicing for self-employed tradespeople

Last updated: 19 December 2024

Invoicing for self-employed tradespeople

If you’re newly self-employed, one of the most important things to learn is how to create and send invoices. Find out how to invoice as a sole trader.

Invoicing as a sole trader doesn’t need to be complicated. With these tips and a little practice, you’ll master this in no time!

What are invoices?

Invoices are legal documents that let your customers know when and how much to pay you.

Invoices for self-employed tradespeople help to keep detailed and accurate records of your company finances.

Plus, they show you how much you've been paid. And this helps when you’re filling in your tax return, and managing your business's cash flow.

If you and your customer are VAT registered, invoicing is a legal requirement. Even if you’re self-employed!

What should be on an invoice?

Making sure your invoice is compliant is essential. This also helps you avoid legal complications in the future.

But what should you include on an invoice?

The details of your company e.g., name, address, phone number

The details of your customer e.g., name, address, phone number

A unique reference or identification number

A description of the work you’re carrying out

Dates of when you plan to do the work, the invoice date, and the date the invoice is owed

The amount of the invoice, and any invoice payment terms

VAT and the final figure owed

Details for how your clients can make payments

Top invoicing advice

Preparing and sending invoices is one of the most important parts of being self-employed.

This is how you’re paid for your work. So, you want to make sure your invoices say everything they need to.

Writing up invoices for self-employed people can be a confusing task if you’re new to it. Because you don’t want to get it wrong. So, you can feel a bit unsure about creating them for customers.

You could be missing quick and easy ways of creating and sending your invoices, even if you’re a seasoned pro.

Get more jobs as a sole trader

Boost customers now

How to invoice as a sole trader

Read our advice on creating a self-employed invoice template for your business.

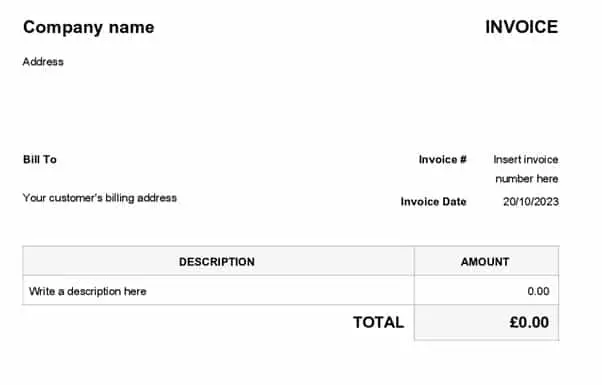

Create and use a template

Creating a standard invoice template for your business is the quickest and easiest way to speed up invoicing. But what needs to go on an invoice?

There are a few pieces of information that legally must be featured on an invoice. However, the most important piece of information on an invoice is how much you’re charging your client, and what for.

These details will, of course, depend on the work you’ve performed for them and when you started.

Use this self-employed invoice template as a guide:

Add lots of detail

You should always put as much detail on your invoice as possible. This helps make payments clear to your client.

It’s also great if you ever need to go through your old invoices.

Once you’ve created an invoice template, filling it out becomes a lot easier. Because it saves you hours of unnecessary work!

If you need help creating a self-employed invoicing template, we’ve made our own that are free to download.

These are for both sole traders and limited companies. And whether your business is registered for VAT or not, we have it all covered for you.

Top tip: Invoice on the move

Self-employed invoice templates are great for making this process as quick and easy as possible. But another great tip is to invoice on the go.

This lets you prepare and send invoices wherever you are, whenever you need to.

Then, you can send invoices when you’re ready, and speed up the payment process. Because the earlier you send an invoice, the earlier a client can pay it.

Use helpful tools

Online accounting software allows you to send and track your invoices. Also, it tracks expenses and other important accountancy information easily.

For instance, Checkatrade members get access to a handy tool for quoting and invoicing. Having numbers all in one place means it is much easier to track your turnover.

More of these services are available to you for your laptop, PC, tablet and mobile. This makes on-the-go invoicing simple, easy, and accessible -no matter where you are.

Make sending invoices easy

Our members are benefitting with our quoting/invoicing tool, and you could too.

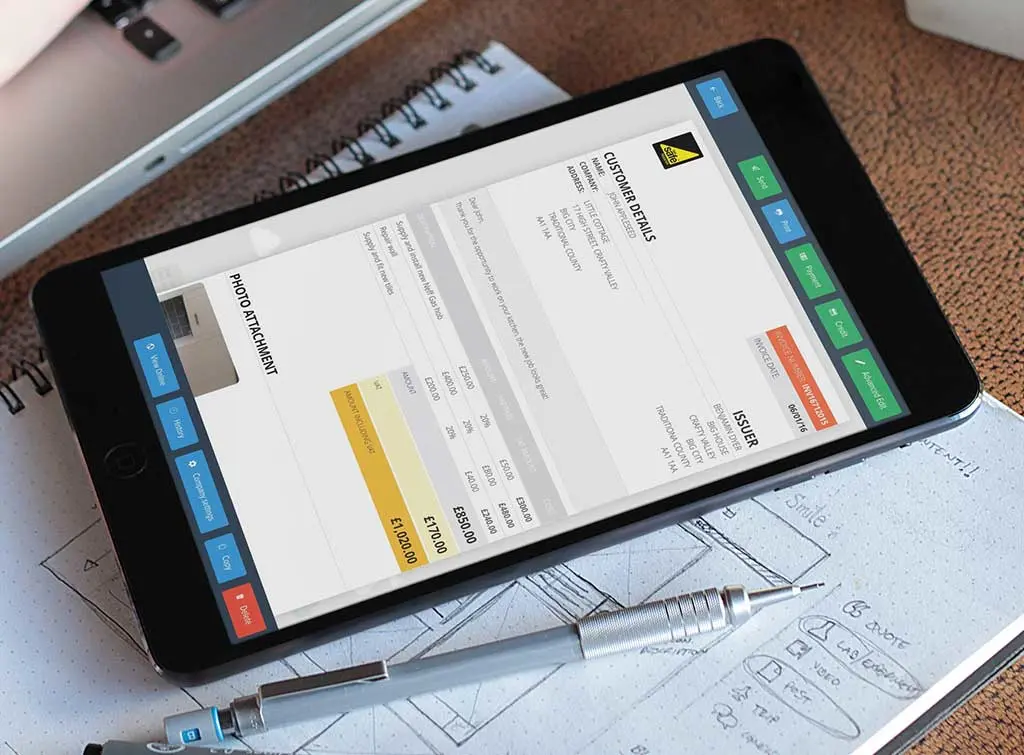

Manage your invoices with a mobile app

By becoming a Checkatrade member, you’ll get access to a free quoting and invoicing mobile tool!

Part of the Checkatrade trades app, there are a range of features and benefits that could help your trade business.

Professional looking quotes

Automatically populated with your relevant business information

Time-saving (around 2.5 hours a week)

Can be easily converted / updated to invoice

App-based for generating paperwork on the go (or on site)

Add jobs from both Checkatrade and elsewhere

Job management software in the app to keep an eye on progress

Easier profile management

Savings through offers and discounts

Nowadays there are many different ways to carry out your quoting. Technology such as video can help your customer journey become even more streamlined.

Make sending invoices easy

Our members are benefitting with our quoting/invoicing tool, and you could too.

When to send an invoice

Most tradespeople have their own preferences for sending an invoice. And there's no right or wrong answer.

Just choose which of the below works best for you:

Immediately

If you need a deposit, send out your invoice just before you start. Or, do this as soon as you start working on the job. For big projects, many tradespeople ask for instalments spread throughout the work.

For example, you might ask for half upfront, and the rest upon completion. Alternatively, you might ask for the material cost upfront and the labour cost on completion.

On completion

Another option is to invoice your customer once you’ve completed the work.

The payment date must be clear on your invoice. This is so your customer knows when the money is due.

Make sending invoices easy

Our members are benefitting with our quoting/invoicing tool, and you could too.

When to send an invoice reminder

When you’ve sent your invoice, your customer/client will have a certain amount of time before the money is due.

However, some customers might forget to pay their invoices on time. That’s why you’ll need to know when to send an invoice reminder.

We’d recommend waiting until a few days before the invoice is due before sending out any reminders.

If your customer doesn’t pay their invoice on time, you’ll need to send regular reminders.

How to deal with late payments and unpaid invoices

It can be frustrating when clients don’t pay their invoices on time. This can also affect your company’s cash flow.

So, you’ll need to know your rights for late payments and unpaid invoices.

Customer refusing to pay for work done? Know your rights

When customers are refusing to pay for work, it can affect your cash flow. On top of that, non-payment can have a generally negative impact on your trade business. So if it happens, don't panic! There are a number of techniques you can use. In this article, we look at scenarios, approaches, and

Invoicing as a sole trader FAQs

Do I need to invoice as a self-employed tradesperson?

This depends on whether you and your customer are VAT-registered. If both of you are, then issuing an invoice is a legal requirement.

However, sending out invoices is also helpful for keeping your records up to date. Especially when it comes to paying taxes.

Can I invoice without being self-employed?

Yes, you can invoice without being self-employed. Just issue a private invoice.

However, this isn’t required by the HMRC and may cause some confusion when you calculate your taxes.

What to remember when invoicing as a sole trader

Invoicing is a brilliant way to keep on top of your company finances.

Invoices must contain a range of essential pieces of information like a unique reference, and payment dates.

As a self-employed tradesperson, providing invoices gives customers all of the information they need.

Invoices help you make sure you've paid the correct amount on the correct date.

Becoming a Checkatrade member is the best way to receive support and help when starting a new business.

Get more jobs as a sole trader

Boost customers now

* Research conducted by Deep Blue Thinking, October 2021.